Introduction: Why Bundle Your Insurance?

Bundling your insurance policies can be a transformative strategy that not only simplifies your life but also opens doors to significant savings. When you combine home and auto insurance with the same provider, it streamlines your relationship with one company, helping you avoid the chaos of managing multiple bills and renewal dates. This one-stop-shop approach not only enhances convenience but also fosters better communication in case of claims or policy updates.

Moreover, insurers often offer substantial discounts for bundled policies, recognizing the loyalty of clients who entrust them with multiple aspects of their financial security. It’s a win-win scenario: while you may enjoy lower premiums, companies benefit from reduced administrative costs associated with managing numerous separate accounts. Additionally, bundling can enhance coverage options; as providers aim to keep bundle customers satisfied, they might throw in perks like enhanced liability coverage or unique add-ons that are hard to come by when purchasing standalone policies. In today’s challenging economic climate, discovering these multifaceted advantages in bundling could make all the difference for your peace of mind and wallet alike.

Top Benefits of Bundling Insurance Policies

Bundling insurance policies offers a unique opportunity not just for savings, but also for streamlined management and peace of mind. When you combine your home and auto insurance, you’re creating a cohesive policy that simplifies the often daunting task of keeping track of individual coverages. This single point of contact allows you to easily manage renewals, changes in coverage, or claims—reducing stress and making life just a little bit easier.

Moreover, bundling can lead to enhanced coverage options that are tailored specifically to your needs. Many providers offer incentives such as higher liability limits or additional protections when policies are bundled, ensuring you receive comprehensive coverage at a competitive rate. Additionally, leveraging this approach can increase your relationship with the insurer; long-term customers often enjoy loyalty discounts or exclusive benefits that regular single-policy holders may miss out on. Ultimately, choosing to bundle isn’t merely about saving money—it’s about crafting an optimized insurance experience designed to fit your lifestyle seamlessly.

Criteria for Selecting the Best Bundles

When selecting the best bundles for home and auto insurance, it’s essential to look beyond mere cost savings. First and foremost, evaluate the coverage limits offered by each provider. A competitive rate might sound appealing at a glance, but ensuring comprehensive protection for both your vehicle and property is paramount. Look into policy specifics—consider factors like liability coverage, personal property protection, and additional riders that could be beneficial in unique situations.

Another critical criterion is customer service reputation. Research customer reviews and ratings to gauge how responsive insurers are during claims processes or general inquiries. A bundle might seem attractive on paper, but if the insurer struggles with timely support when you need help most, that could outweigh any potential savings. Lastly, explore available discounts; some providers offer incentives not only for bundling policies but also for multiple vehicles or smart home technologies—a modern twist worth considering as you weigh your options. Balancing these elements will empower you to make an informed decision that secures peace of mind without breaking the bank.

Review of Leading Insurance Providers

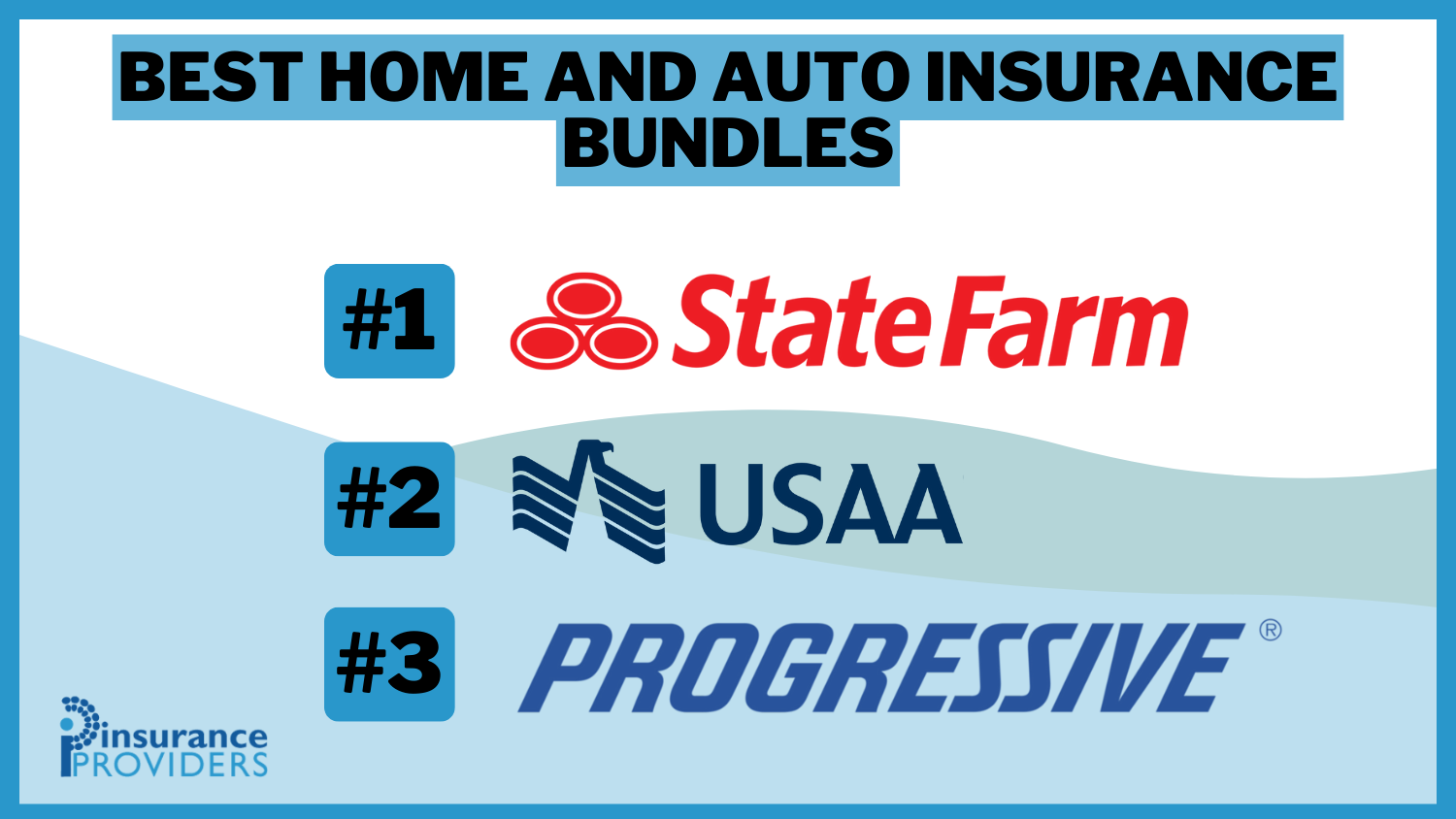

When it comes to home and auto insurance bundles, a few leading providers consistently stand out due to their innovative offerings and exceptional customer service. State Farm shines with its extensive local agent network, offering personalized consultations that empower customers to tailor coverage precisely to their needs. Their bundled discounts make securing comprehensive protection more affordable, while the user-friendly mobile app provides convenient access to policy information and claims filing.

Meanwhile, Progressive takes a modern approach by utilizing advanced technology for price comparisons and personalized quotes. Their Name Your Price tool allows customers more control over premiums by tailoring coverage options within budget constraints. Additionally, Progressive’s snapshot program incentivizes safe driving behavior, rewarding users with significant savings—a compelling feature for young drivers or those seeking lower rates without compromising on quality. In this evolving landscape of insurance, choosing the right provider often hinges on individual circumstances; however, these leaders exemplify how bundling can enhance value while streamlining the insurance experience.

Comparative Analysis of Coverage Options

When evaluating home and auto insurance bundles, it’s crucial to delve beyond just premiums and discounts. Coverage options vary widely among providers, making it essential to compare what is truly included. For instance, while one insurer may offer comprehensive collision coverage for auto policies, another might provide extensive dwelling protection in their homeowner’s policy. Assessing the nuances—such as personal property limits or liability coverage caps—can reveal significant differences that directly affect your financial security during an unexpected claim.

Additionally, don’t overlook customizable riders that some insurers offer. These add-ons can be particularly beneficial; like a scheduled personal property endorsement for high-value items in homeowners insurance or roadside assistance within auto policies. A bundled package that allows flexibility and tailored protections not only enhances peace of mind but may also prove to be more economical over time. By taking a holistic approach to understanding these options, you empower yourself to select a bundle that offers not just savings but the most substantial coverage tailored perfectly to your needs.

Tips for Maximizing Your Savings

To truly maximize your savings when bundling home and auto insurance, it’s essential to delve into the specifics of your coverage needs. Rather than opting for the most popular bundle, take a proactive approach by assessing what’s actually necessary for your situation. For instance, consider factors like your driving habits and home location—these can significantly influence premiums. Engaging with an insurance agent who takes the time to understand your lifestyle can unlock discounts you may not have known about.

Additionally, don’t overlook the power of regular policy reviews. Many people secure their policies and forget about them; however, changes in circumstances or market conditions can lead to better options down the line. Set a calendar reminder every year to evaluate whether you’re still getting the best deal or if bundling further could enhance your savings. Finally, make sure you inquire about loyalty bonuses or multi-policy discounts that often come with long-term commitments but are all too frequently overlooked in the fine print—these little-known perks can add up remarkably over time!

Conclusion: Choosing the Right Bundle

In the ever-evolving landscape of insurance offerings, selecting the right bundle demands a careful examination of not only cost but also comprehensive coverage and personalized service. Your unique circumstances—such as your lifestyle, driving habits, and property value—should steer your choice. It’s worth delving into each provider’s reputation for customer service and claims processing; after all, an excellent policy is only as good as the support behind it.

Moreover, consider future-proofing your decision by assessing potential discounts for life changes like home renovations or purchasing additional vehicles. Some providers offer loyalty programs that reward long-term customers with escalating benefits. Ultimately, a well-chosen bundle isn’t just about immediate savings; it should instill peace of mind by ensuring you’re adequately protected against unforeseen circumstances while being tailored to fit your individual needs seamlessly. Keep in mind that this investment in security might just be one of the best decisions you make for your financial well-being this year.