Does Insurance Cover LASIK?

When considering LASIK eye surgery, many people wonder about insurance coverage. LASIK can be a significant investment, and understanding your insurance options is crucial. This guide will help you navigate the complexities of insurance coverage for LASIK, factors that influence it, and alternative financing options.

Understanding LASIK Eye Surgery

LASIK, or Laser-Assisted In Situ Keratomileusis, is a popular procedure to correct vision issues like myopia, hyperopia, and astigmatism. The surgery reshapes the cornea to allow light entering the eye to be properly focused onto the retina for clearer vision. While LASIK can offer freedom from glasses and contact lenses, the cost can be a barrier for many.

General Insurance Coverage for LASIK

Most insurance companies categorize LASIK as an elective procedure. This means that it is typically not covered under standard health insurance plans. However, some vision insurance plans may offer partial coverage or discounts on LASIK procedures. It is essential to review your specific insurance policy or contact your provider directly to understand the extent of coverage available.

Factors Affecting LASIK Insurance Coverage

Type of Insurance Plans

Insurance plans vary widely in what they cover. Standard health insurance often excludes elective procedures like LASIK. However, specialized vision insurance plans might offer some benefits. It’s important to check both your health and vision insurance policies.

Medical Necessity and Documentation

In rare cases, LASIK may be deemed medically necessary, for instance, if a patient is unable to wear glasses or contact lenses due to physical constraints or severe allergies. Proper medical documentation and a strong case presented by your ophthalmologist can sometimes sway insurance providers to cover part of the cost. Always consult with your eye care professional to explore these possibilities.

Steps to Determine Your LASIK Insurance Coverage

- Review Your Policy: Start by carefully reading through your health and vision insurance policies. Look for any mention of LASIK or refractive surgery coverage.

- Contact Your Insurance Provider: Call your insurance company directly to inquire about LASIK coverage. Ask specific questions about what conditions might qualify for coverage.

- Consult with Your Ophthalmologist: Your eye doctor can provide detailed information and documentation about your vision needs. This can be crucial if you need to argue for medical necessity.

- Check for Employer Benefits: Some employers offer additional vision benefits or partnerships with LASIK providers. Check with your HR department for more information.

Alternative Financing Options for LASIK

If insurance does not cover your LASIK procedure, there are several alternative financing options to consider:

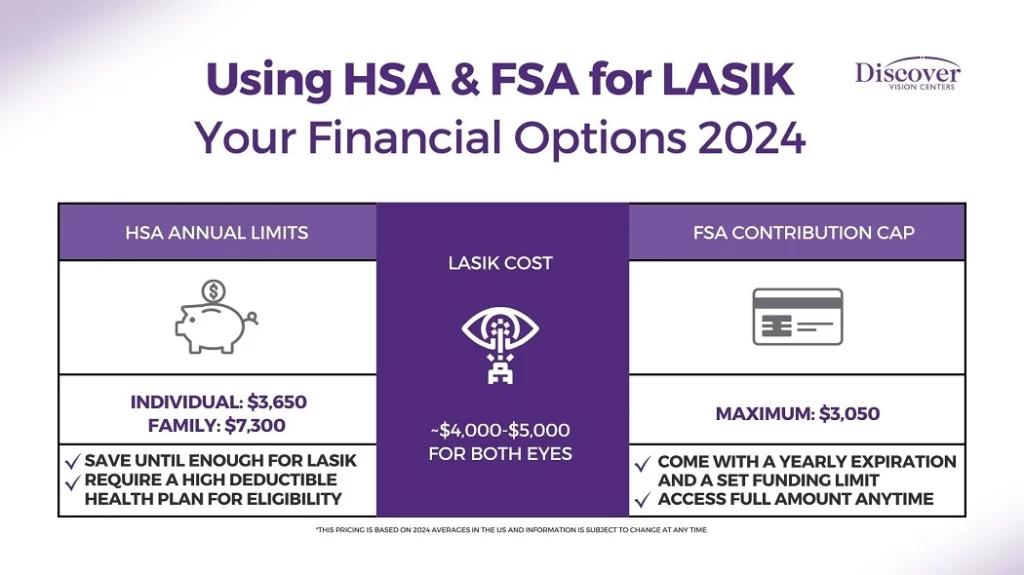

- Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs): These accounts allow you to use pre-tax dollars to pay for LASIK.

- LASIK Financing Plans: Many LASIK centers offer financing plans with low or no interest rates to make the procedure more affordable.

- Credit Cards and Personal Loans: Some patients opt to use credit cards or personal loans to finance their LASIK surgery. Ensure you understand the interest rates and repayment terms.

Frequently Asked Questions About LASIK Insurance

Q: Is LASIK ever covered by insurance? A: In most cases, LASIK is considered elective and not covered. However, certain vision insurance plans may offer partial coverage or discounts.

Q: How can I find out if my insurance covers LASIK? A: Review your insurance policies, contact your insurance provider, and consult with your ophthalmologist. Checking employer benefits may also provide additional options.

Q: What are the costs of LASIK without insurance? A: The cost of LASIK varies but typically ranges between $2,000 to $3,000 per eye. Financing options can help manage these expenses.

Q: Are there alternatives to LASIK that might be covered by insurance? A: Yes, alternatives like PRK or corrective lenses might be covered under certain conditions. Consult with your eye care professional to explore all your options.

Understanding whether your insurance covers LASIK requires careful research and communication with your insurance provider and eye care professionals. While most insurance plans do not cover LASIK, alternative financing options are available to help make the procedure more affordable.