Compare Life Insurance: Finding the Best Policy for Your Needs

Life insurance is an essential financial tool that provides security and peace of mind for you and your loved ones. Whether you are looking to protect your family, secure your assets, or plan for the future, comparing life insurance policies is a crucial step in finding the right coverage. In this guide, we will explore the key factors to consider when comparing life insurance options, helping you make an informed decision.

Why Compare Life Insurance Policies?

Not all life insurance policies are created equal. Each policy differs in terms of coverage, premiums, benefits, and terms. Comparing life insurance policies ensures that you:

- Get the Best Value: Choose a policy that provides maximum benefits at an affordable cost.

- Understand Coverage Options: Identify a policy that aligns with your financial goals and family needs.

- Avoid Hidden Costs: Learn about fees and exclusions that might affect your policy’s value.

- Secure Peace of Mind: Ensure that your loved ones are adequately protected.

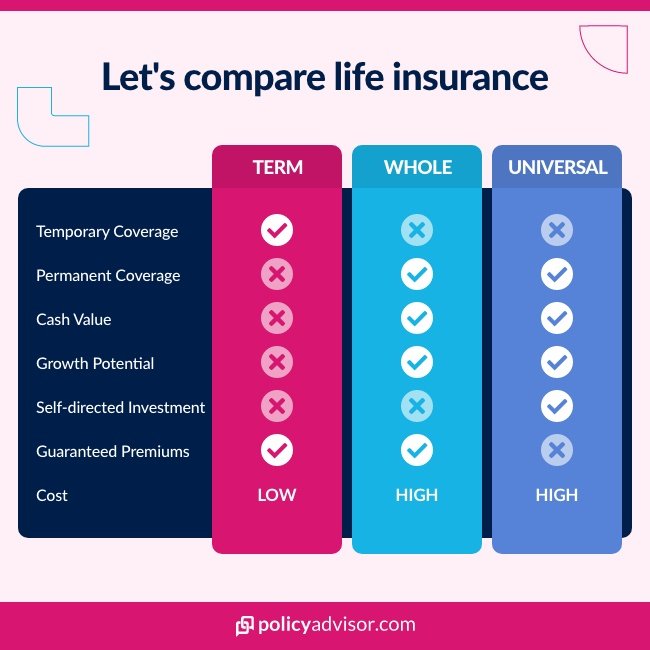

Types of Life Insurance Policies

Understanding the types of life insurance policies is the first step in comparing options. Here are the primary categories:

1. Term Life Insurance

- Overview: Provides coverage for a specific period (e.g., 10, 20, or 30 years).

- Best For: Individuals seeking affordable, temporary coverage.

- Pros: Low premiums, simple structure.

- Cons: No cash value; coverage ends when the term expires.

2. Whole Life Insurance

- Overview: Offers lifelong coverage with a cash value component that grows over time.

- Best For: Those seeking permanent coverage and a savings component.

- Pros: Guaranteed death benefit, cash value accumulation.

- Cons: Higher premiums compared to term policies.

3. Universal Life Insurance

- Overview: A flexible policy with adjustable premiums and death benefits.

- Best For: Individuals wanting lifelong coverage with investment options.

- Pros: Flexibility, cash value growth.

- Cons: Complex structure, potential for higher costs.

4. Variable Life Insurance

- Overview: Includes investment options, allowing policyholders to invest the cash value in various funds.

- Best For: Those comfortable with risk and seeking investment opportunities.

- Pros: Potential for higher returns, lifelong coverage.

- Cons: Investment risk, high fees.

5. Final Expense Insurance

- Overview: Designed to cover end-of-life expenses such as funeral costs and medical bills.

- Best For: Seniors or individuals seeking coverage specifically for final expenses.

- Pros: Affordable premiums, simplified application process.

- Cons: Limited coverage amount, not suitable for broader financial goals.

6. Group Life Insurance

- Overview: Often offered by employers, providing basic life insurance coverage as part of employee benefits.

- Best For: Employees looking for supplemental coverage at low cost.

- Pros: Convenient, affordable.

- Cons: Limited coverage, often not portable if you change jobs.

Key Factors to Compare Life Insurance Policies

When comparing life insurance policies, consider the following factors:

1. Coverage Amount

Determine how much coverage you need to protect your loved ones. Consider expenses such as mortgage payments, education costs, and daily living expenses. A good rule of thumb is to select a coverage amount that is 10-15 times your annual income.

2. Premium Costs

Compare premiums across policies to find one that fits your budget. Ensure you understand whether premiums are fixed or adjustable. Keep in mind that while term life insurance has lower premiums, permanent policies like whole or universal life may offer additional benefits that justify higher costs.

3. Policy Terms

Examine the duration of the coverage and any conditions for renewal. For term life policies, check if they are convertible to permanent policies. For permanent policies, review the terms regarding cash value growth and withdrawals.

4. Riders and Add-Ons

Look for optional riders that enhance your coverage, such as:

- Waiver of premium: Premiums are waived if you become disabled.

- Accidental death benefit: Provides an additional payout if death occurs due to an accident.

- Critical illness coverage: Offers a lump sum if diagnosed with a severe illness.

- Child term rider: Provides coverage for your children under the same policy.

5. Insurer Reputation

Choose a reputable insurance provider with strong financial ratings and positive customer reviews. This ensures reliability and timely claim settlements. Look for ratings from agencies like A.M. Best, Moody’s, or Standard & Poor’s.

6. Exclusions and Limitations

Carefully review the policy’s terms and conditions to identify exclusions that may impact your coverage. Common exclusions include deaths caused by risky activities, suicide within the first two years, or pre-existing health conditions.

7. Cash Value Component

For permanent life insurance policies, consider how the cash value grows and whether it aligns with your financial goals. Evaluate interest rates, investment options, and withdrawal or loan terms.

Steps to Compare Life Insurance Policies

Here are actionable steps to effectively compare life insurance options:

- Assess Your Needs: Determine the amount and type of coverage you require. Consider factors such as dependents, debts, and long-term financial goals.

- Gather Quotes: Request quotes from multiple insurers to compare premiums and coverage options. Use online comparison tools or work with an independent insurance agent.

- Evaluate Policy Features: Compare the details of each policy, including coverage amount, riders, exclusions, and flexibility.

- Check Insurer Credentials: Research the financial strength and reputation of each insurance provider.

- Consult Professionals: Speak with a financial advisor or insurance expert to clarify doubts and receive personalized recommendations.

- Read the Fine Print: Thoroughly review policy documents to understand all terms and conditions.

Common Mistakes to Avoid When Comparing Life Insurance

- Focusing Solely on Premiums: Low premiums can be attractive, but they may come with limited benefits or higher long-term costs.

- Ignoring Exclusions: Overlooking policy exclusions can lead to unexpected claim denials.

- Choosing Insufficient Coverage: Underestimating your financial needs may leave your family underprotected.

- Delaying the Decision: Waiting too long to purchase life insurance can result in higher premiums as you age or develop health issues.

- Not Reviewing Policies Regularly: Life changes such as marriage, children, or career advancements may require updates to your coverage.

How to Save Money on Life Insurance

- Buy Early: Premiums are generally lower when you are younger and healthier.

- Maintain a Healthy Lifestyle: Avoid smoking, excessive drinking, and maintain a healthy weight to qualify for better rates.

- Bundle Policies: Some insurers offer discounts for bundling life insurance with other policies like home or auto insurance.

- Pay Annually: Paying premiums annually instead of monthly can save on administrative fees.

- Shop Around: Comparing quotes from multiple providers ensures you get the best deal.

Final Thoughts

Comparing life insurance policies is a critical step in securing your financial future and protecting your loved ones. By evaluating coverage options, premiums, and benefits, you can select a policy that meets your needs and provides peace of mind. Take the time to research, consult professionals, and make an informed decision—your family’s security depends on it.

Remember, life insurance is not just a financial product; it is a commitment to safeguarding your family’s future. Investing time in comparing policies today will pay off in the long run, ensuring you leave behind a legacy of care and support for those you love most.